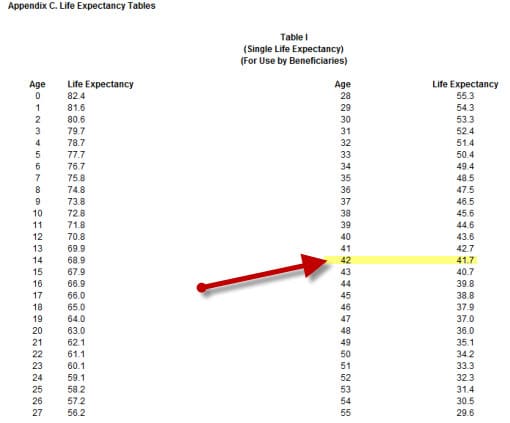

Inherited Ira Life Expectancy Table. Note that the single life table is never used by traditional ira owners or retirement plan participants, including tsp participants, to calculate their rmds. $4,761.90 ($100,000 / 21.0) 2017 life expectancy factor (revised annually for spouse beneficiaries based on the irs single life expectancy table) 20.2:

Spouse may treat as her/his own; That withdrawal is known as a required minimum distribution (rmd). Life expectancy is calculated using the beneficiary’s age in the year following the year of the ira owner’s death.

RMD Tables

The irs has released new life expectancy tables for calculating required minimum distributions (rmds) for 2022. Each year and recalculate life expectancy. Fair market value of inherited ira on 12/31/2015: The uniform lifetime table is used by most ira owners who need to take 2022 lifetime rmds.